Here’s What Being “House Poor” Means — And How You Can Avoid It

Have you ever heard the expression “house poor” and wondered, “What exactly does that mean?”

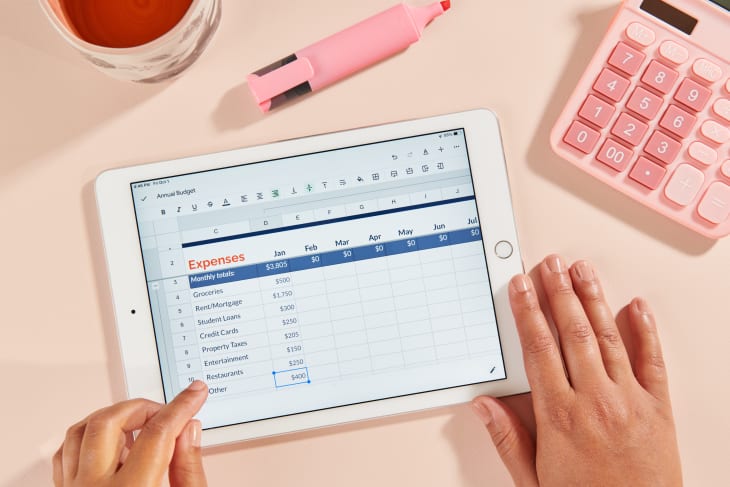

When someone uses this phrase, it usually suggests that they’re spending a large chunk of their monthly income on their mortgage and accompanying housing costs — things like homeowner’s insurance, property taxes, and HOA dues. While they’re building equity with homeownership, their budget is stretched thin and they may have a hard time budgeting for other expenses while they keep up with their monthly mortgage payments.

Generally, financial experts suggest that you spend less than one-third of your monthly take-home pay on your rent or mortgage, says Danetha Doe, Clever Real Estate‘s economist and spokesperson, as well as the creator of personal finance site Money & Mimosas.

“Some signs that you are house poor include not being able to cover the expenses of necessities such as utilities, groceries, and transportation,” Doe says. “Other signs are if you are unable to contribute to your savings or investment goals each month.”

If you are currently in this situation, you can try to refinance your mortgage for a lower interest rate, Doe suggests, which will lower your monthly payment and free up some room in your budget.

Here are some more smart strategies that will help you avoid becoming “house poor,” according to financial experts.

Don’t Wipe Out Your Savings When You’re Buying

The best antidote to being house poor is to plan ahead as much as possible, says Lauren Bringle, accredited financial counselor at Self Financial. Remember, a down payment isn’t the only cost associated with homebuying, Bringle says. “There are closing costs, repairs, maintenance, utilities, property taxes, and more to account for,” she says. “Build as much cushion into your savings as possible so you’re financially resilient.” For your budget-planning: Closing costs are typically 2 to 5 percent of your loan, and they can be rolled into your mortgage.

Know Your Budget

Factors like excellent credit and a low debt-to-income ratio may help you qualify for a higher loan amount (and more favorable terms). But just because you can qualify for a higher mortgage loan, doesn’t mean you have to accept the full amount, cautions Bringle. “If you can buy less house, or find a home that’s a better value that still meets your needs, don’t feel obligated to accept the full amount, which would just mean a higher mortgage payment,” Bringle suggests. “Instead, pay for the amount of house you need, and take out the right loan to cover that amount.”

Get a Home Inspection

It’s a sign of the crazy homebuying times: Some buyers have been waiving property inspections to sweeten their offer. But unless you’ve got lots of cash to fix potentially costly repairs (A leaky roof! Cracks in the foundation! An aging HVAC system!), Realtors and financial experts advise you to get a home inspection. In a best-case scenario, the seller will get the problems fixed before you move in or give you a price reduction. But if not, at least you know the ballpark of how much repair expenses will be and you can determine whether they fit comfortably in your budget.

Another pro tip: Get estimates and bids on potential home repairs before buying a fixer upper and add extra to the budget for unforeseen expenses, says personal finance and money-saving expert Andrea Woroch.