Here’s Why I Color-Code All My Bill Payments — and How It Helps Me Save Money

I’ve always played around with different ways to organize my day-to-day life, including my bullet journal and to-do list for different chores and tasks. In my quest to make bill-paying easier, I’ve worked with Excel spreadsheets, tried online tracking for bill paying, and used a paper calendar. Frustratingly, these methods haven’t always worked for me — but I knew it was important to find a way that would stick because budgeting and financial health is one of my top priorities.

By trial and error, I adapted a system that helps me keep track of fixed and variable expenses, savings, and when payments are due every month: I color-code things!

Using color coding in my day-to-day planner is a convenient way to keep everything — including expenses, savings, income goals, and planning for the future — in one place. Adding a visual element like color also means I don’t have to think too much about what’s pending and what needs to be paid at the beginning of each month.

Step 1: Know what planner and tools you’re going to use

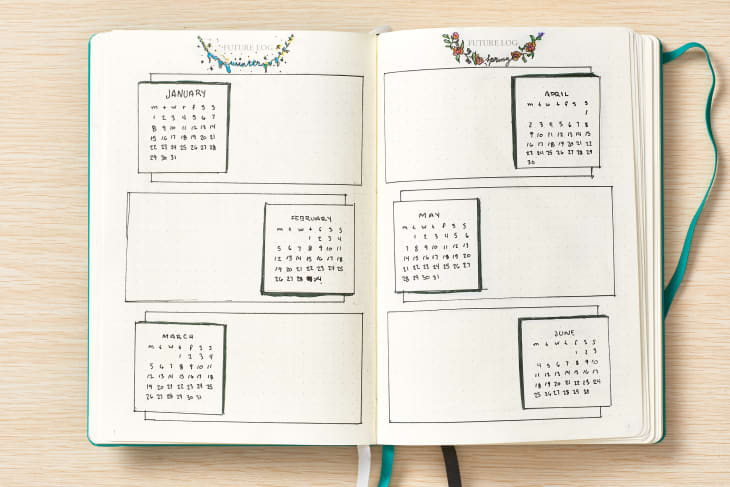

When I started looking through different journals and planners, I knew I needed a notebook with a monthly and weekly calendar, as well as blank pages that would help me coordinate several pieces of information. I decided on a black Moleskine planner because it allowed me to track my expenses on the calendar and make notes in the blank pages midway through the planner. I could also flip back and forth between the two easily, therefore helping me keep track of pending and paid bills, as well as monthly and yearly goals.

Using colored highlighters, pens, or labels will make it easier to identify different expenses in your planner. I prefer to use different color pens in my planner, but don’t be afraid to experiment with what works best for you.

Step 2: Assign different colors to each category.

Red: Fixed Expenses

There are some bills you know to expect — they’re due every month or every few months, and are often around the same amount each time. The more you can get in the habit of automating these payments, the better.

“We never want to be late on our fixed expenses, which includes items like paying yourself first for savings, mortgage/rent, electric and water bills, cell phone and television payments, as well as insurance,” Jaclyn Strauss, a Florida-based CPA, tells Apartment Therapy. She recommends jotting down the bills onto your calendar a week before their due date, and a red color can help you pay attention to their immediacy.

Given that red is often associated with danger (think stop signs, ambulance sirens, and traffic lights) and its ability to elicit an emotional response, using red as a color-coded category may help you pay attention — after all, falling behind on these payments could adversely impact your life. To put this into practice, Strauss recommends working with each company to ensure that your bill falls around roughly the same time as the others, if you can. “You can call the company and ask that your billing cycle be changed to obtain this,” she says. “This allows you to streamline all of your red color-coded items into a one-week time frame on your planner.”

When I flip through my planner and (literally) see “red,” I double-check those bills have been paid. I like how my brain is immediately alerted when I see a red number in my planner — so that I don’t see a red balance on my next bill.

Yellow: Variable Expenses

Every month, you’ll have variable expenses, such as food, gas, or clothing — you can likely anticipate them, but due to frequency of use, they might not have a final number until you pay for the items themselves. “To plan for these expenses, take the average amount of money you spent on the items like clothing and food over the last six months,” advises Strauss. In your planner, color code these expenses in yellow, and schedule them for three business days before they’re due. (Otherwise, earmark the funds and keep a log of your spending in the yellow color.)

If you’re looking to cut back on your shopping overall, designating a day to schedule food, clothing, or miscellaneous expenses can help you both budget and limit this kind of spending to a few times of month. I’m proof that it works: For several months, I tracked these expenses and realized I spent less when I appointed a couple of days a month as designated “shopping days” instead of randomly buying things throughout the month. Of course, there are moments where you run out of something before your shopping day happens — if that occurs, it’s more than understandable to run to the store for that item alone.

Green: Discretionary Spending

After you deduct all of your expenses in the red and yellow categories, any funds that remain can be marked as green. “Green means go: this money is discretionary and ‘leftover’ money that can be prioritized for savings, activities, extra subscriptions like Netflix, and travel,” Strauss says. (If savings are a major goal to you, you can always earmark it as a red, or fixed expense — think of it as paying a bill to yourself each month. If you’re working on a different money goal, this might be a lower priority to you.)

By creating a green category, you can decide during the month if you have the leeway to spend a little extra on an entertainment expense or have additional funds to deposit into your IRA. This category might be on the lower side during certain months, so plan accordingly if you have a particularly flush month on hand.

Blue: Meetings

Things changed for me once I realized that my day-to-day obligations shouldn’t be considered as being separate from my financial goals. Color-coding important meetings in your professional and personal life is imperative for long-term financial strategy. “Since COVID-19, we became accustomed to very little in-person interaction in regards to meetings and appointments, and met on Zoom,” says Strauss. Whether your meetings going forward are virtual or in-person, she recommends leaving yourself time to prepare and travel if needed.

Step 3: Make Sure Your Payments Are as Automated as Possible

The best bill-paying system is one that will work for you. Some people like to integrate a paper-based planner with online bill paying, while others are digital all the way.

“Automate as much as possible using your color-coded planner as your guide to move online,” suggests Strauss; if you can take advantage of automatic payments for your fixed expenses in particular, she urges you to consider enrolling. This creates a back-up plan to your paper-based system ensuring you won’t miss any payments, and allowing you the ability to both pay your bills on time and work toward future income goals simultaneously.