7 Tips and Tricks I Use to Make Budgeting More ADHD-Friendly

With inflation top of mind and holiday shopping fast approaching, many people are reevaluating their financial health. If you have ADHD like I do, you may find a lot of conventional financial advice doesn’t resonate or reflect the way neurodiverse minds think.

People with ADHD experience symptoms including impulsivity, disorganization, and poor planning. These characteristics make everyday tasks like budgeting a challenge.

After years of soaring Seattle rents and weeping as I make student loan payments, I’ve figured out a few methods for managing my finances — even if some are, admittedly, works in progress. Here are a few tips this ADHDer has learned along the way.

Be realistic with your budget.

First, take care of necessities like rent, groceries, utilities, and pet food. Then, fill in any remaining categories with nice-to-haves. Basically, don’t hold yourself to unreasonable standards. Instead, leave some room to splurge with rewards that help you achieve your next goal.

I’ve managed to spend months saving every extra dollar, only for it to come crumbling down after I got sick of never eating out or getting a much-needed pair of new shoes. Pushing past a healthy degree of restraint can result in burnout and counterproductive stress spending.

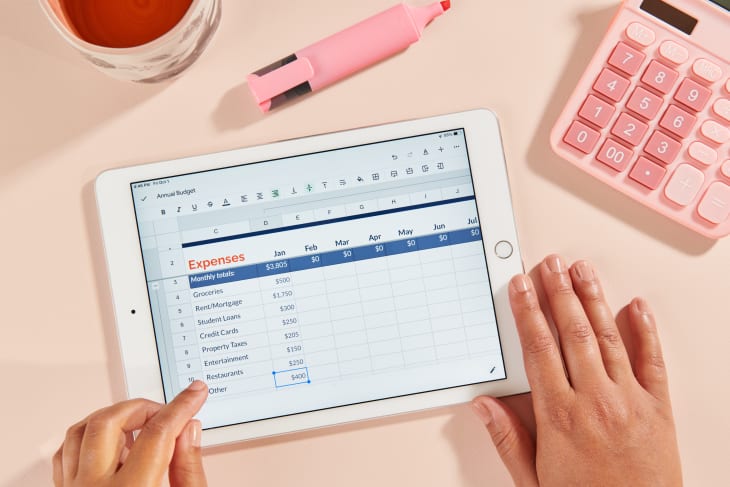

Need some help getting started? Check out these apps that simplify budgeting and curb overspending habits.

Get an accountability partner.

Find someone willing to help motivate you to stick to your goals, whether they’re a significant other, family member, or trusted friend.

I’ve found that having someone to check in and celebrate successes with is a strong motivator. This way, you can set goals together or even make it a friendly competition so you both stay on track.

Simplify your savings.

Set-it-and-forget-it systems are a great solution to avoiding late payment fees. As someone who has worked hourly jobs and lived paycheck to paycheck, I know there are times when autopay isn’t doable. If you can, try automatic savings programs that set aside small amounts of your income on payday or a recurring schedule. Most checking and savings accounts include these features.

Sites like Acorns help make automatic, long-term investments. This has been a great solution for stashing some of my cash, no matter my current workplace’s benefits package or if I’m freelancing. The best part? I get to forget about it for months.

Track your progress.

Services like Credit Karma are a real lifesaver for monitoring credit reports. In addition to watching out for derogatory marks and identity theft, they make all the difference in identifying rising balances and cutting down on accrued interest.

I find that it can be helpful to gamify finances to celebrate wins. Most finance apps will send encouraging progress updates that are perfect for firing up the brain’s reward centers.

Level up your motivation.

For me, seeing is believing — especially as someone who is not a numbers person. Like a video game, visualizing goals in the form of rising graph lines gives a similar feeling to powering up a character or collecting gold coins.

Limit your impulsivity.

Years ago, it was popular to limit spending by freezing credit cards. Modern conveniences have become major enablers, with auto-fill card numbers, Google and Apple Pay, and smartwatches that can pay at self-checkout. Having to thaw a credit card is one thing, but freezing your devices? I wouldn’t try it. If you’re shopping IRL, consider carrying cash, not cards.

You may even try unsubscribing from daily deals emails that are too tempting. Many banks also offer delayed transfers and locking methods to help limit spontaneous spending. Finally, consider checking your budgeting app of choice for alert features. Most will have some option to notify you when you’re nearing your monthly entertainment or coffee budget.

Forgive your mistakes.

ADHDers tend to be hard on themselves when it feels difficult to do what others find easy. As someone who prefers immediate satisfaction and results, it’s harder to continue motivating myself when eliminating debt or saving large amounts has no end in sight. When paying off a credit card, it can take months, if not years, to see that work reflected in credit scores. Finding ways to celebrate progress and move on from past mistakes can make all the difference.

Looking for more money resources? Check out the easiest budgeting hacks shared by Apartment Therapy readers.