“Financial Minimalism” Completely Transformed My Relationship with Money — Here’s How It Can Help You Budget

People today live in an era of ample financial choice, where navigating the sea of banking, budgeting, and investing options can be daunting. Couple these options with the influence of behavioral economics and expert advice, and every financial decision becomes a chore. Self-proclaimed financial gurus, #FinanceTok, and popular Reddit forums have contributed to this information saturation and made it that much harder for Millennials and Gen-Zers — avid consumers of these platforms — to get their financial footing.

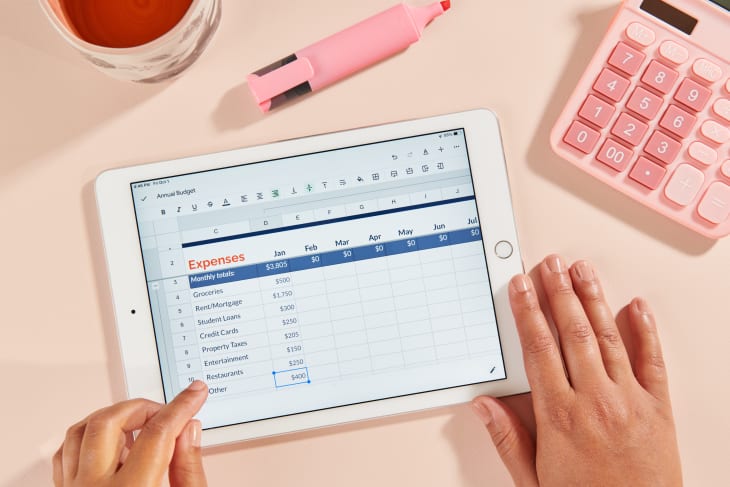

For much of my financial literacy journey, I’ve opted for a more complex approach to money management. I lived in spreadsheets, treated accounts like envelopes, and stressed over minuscule decisions. Multiple moves across states also meant that I was spread thin across several banks, and, a sucker for rewards credit cards, and had given in to the allure of churning. Despite automating a lot of my finances, juggling accounts and cards across multiple institutions became overwhelming.

Getting married and considering how to combine finances with my spouse prompted me to re-evaluate how I track, categorize, and manage my money. I knew my maximalist approach wouldn’t do me any good with another set of finances in the picture. Something had to change, and, recognizing the importance of transparency, simplification became the clear, practical answer. Enter: financial minimalism.

Note: Personal finance is personal. There is no one-size-fits-all solution, so consider my experience in the context of your own personal values, life circumstances, and financial philosophy. It’s about what works for you.

What Is Financial Minimalism?

Achieving financial minimalism requires you to take a look at where your money is coming, going, and accumulating, and the infrastructure set up to facilitate this money movement.

My personal approach to financial minimalism is guided by three key pillars of simplification: structure (accounts, credit cards), strategy (saving and investing), and spending.

Structure

There was a point in time in which I had 10 accounts across four different banks. Checking and savings accounts were earmarked by purpose and even included a “pet savings” account for my dog’s insurance and potential medical expenses. My retirement and investments followed a similar pattern. It’s no wonder I felt financially scatterbrained.

Since my husband and I settled on a hybrid approach to merging our finances, I decided to clean house and cut my number of accounts in half. One checking, one savings, one employer-sponsored retirement, one investment. (We also each have our own checking for personal use). If consolidating categories like sinking funds, emergency funds, and pet savings under a single umbrella is unsettling, consider tools like YNAB, which offer an envelope-like budgeting view. Understandably, some situations warrant the need for multiple checking or savings accounts. In these cases, YNAB is also helpful if still you prefer to maintain multiple accounts, but want to see a holistic, categorized view of balances and spending patterns.

The other foolproof way to simplify your financial infrastructure is to limit your number of credit cards. Do your research with an engine like Nerdwallet and identify the type of rewards card that best suits your lifestyle. (Do you prefer flight miles, hotel points, cash back, etc.?) Minimizing cards makes it easier to track your balance, in turn, minimizes the potential impact to your credit score and interest rates. Likewise, credit cards, especially when rewards are involved, may incentivize spending.

Strategy

A simple, straightforward strategy can help you manage your money with ease. Just as it helps to have recurring expenditures automated, automating transfers for savings and investments can help you achieve your financial goals.

In the realm of personal finance, strategy is often most linked to investing. Whether you prefer to dabble in cryptocurrency, meme stocks, or stick to the Bogleheads method, create a plan, and stay consistent. Rather than speculating or trying to time the market (spoiler alert: you can’t) — consider the dollar-cost average principle and invest periodically, such as on a biweekly or monthly basis. This tactic reduces risk and prevents impulsive financial decision making. In the name of diversification, and in reacting to market volatility, I often used to dump sums of money into stocks. Unless you have an appetite for risk or time and energy to research, index funds are the way to go.

Spending

While financial minimalism isn’t necessarily minimalism in the material sense, the two are complimentary. Though you can limit your spending through things like serial budgeting and scaling back subscriptions, there are other measures that won’t have much impact on your lifestyle — but will still cut back your spending. For example, you may revisit providers, such as internet, phone, and cable, or bundle insurance policies. Several insurance companies offer reduced rates if you maintain all your policies with them.

For more material things, consider where you can borrow or rent instead of buy. Borrowing everything from books (hello, library card!), to clothing, to athletic equipment that may involve infrequent or one-time use, will help reduce costs and clutter.

Concrete Outcomes

Aside from the more obvious outcomes of reduced time and effort, financial minimalism has made it easier for me to achieve my financial goals. Prior to downsizing my credit cards, I’d feel inclined to spend to maximize my rewards. How counterintuitive is that? Furthermore, with fewer accounts to link to automated payments, I never have to remember how much, and from where, bills have been paid.

Perhaps most transformative is the impact it’s had on my relationship with money. While I thought consolidating my money into fewer accounts and cards would make it easier to lose track of my spending, with everything laid out in front of me, I’ve become more intentional about where I spend. Taken together, the benefits of financial minimalism make for a financial plan that is not only simple, but sustainable. And when it comes to money, I’m in this for the long-haul.