8 Venmo Tips You Didn’t Know You Needed

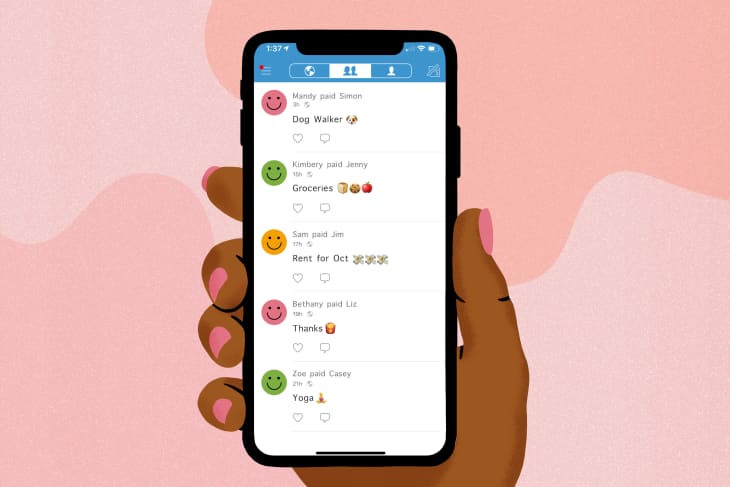

Venmo and other peer-to-peer payment tools have made paying for stuff quite a bit easier these past few years. Instead of asking the waitress at your favorite restaurant to split the bill among your pals and run six credit cards (while referring to a complicated, hand-written list of what food and drink orders should go on each card), now you can send and receive money via the Venmo app on your phone. And you can add fun emojis to boot. Taco Tuesday, anyone?

From splitting rent with roommates to shopping online, Venmo is incredibly useful in all sorts of situations. But there’s more than meets the eye with Venmo, which is owned by Paypal. Here are eight tips you probably didn’t know you needed for making the most out of this handy app.

You should always confirm usernames before sending or receiving payments.

It’s a fairly common scenario: You’re selling something on Facebook Marketplace or Craigslist and you tell a prospective buyer, “Just Venmo me!” A few seconds later, they ask if you’ve received the payment. You open the app, pull down to refresh, and… nothing. Turns out, they sent the money to someone else on Venmo with the same or a similar name. Yikes! Now they’re totally at the mercy of that random person to return the money. Fingers crossed that person is a Good Samaritan.

There’s an easy way to avoid this issue. Toggle over to the “Venmo me” profile page in the app, which features your name, your user name, your profile picture, and your unique QR code. You can send this page to someone via email, text message, instant messenger, and a whole host of other apps. If you’re meeting someone in person, they can scan your QR code with their phone, too. “After you scan a friend’s QR code, you’ll be taken directly to their profile page,” says Erin Mackey, a Venmo spokeswoman. “There, you can add them as a friend, send, or request funds.”

You can link a joint bank account to Venmo.

You don’t technically need to link a bank account to your Venmo account, though most people do. Your bank account balance can help cover payments that are larger than your Venmo balance, and you can also seamlessly transfer money in and out of Venmo via your bank account.

But what if you share a bank account with someone, like a spouse or partner? Venmo recently added the capability to link a joint bank account, which can help make things easier if you’ve got combined finances.

You can politely nudge friends to pay up.

The first of the month has come and gone and your roommate still hasn’t paid her share of the rent. What to do? These situations always feel super awkward. Venmo has a handy “remind” feature that gently nudges your friends to pay you back. And don’t fret about reminding someone too soon, either. According to Venmo’s data, 67 percent of the app’s users agree that it’s appropriate to remind someone to pay within four days of the original transaction, Mackey says.

You can use emojis and Bitmojis to your heart’s content.

At its heart, Venmo is a social experience—it’s like a cross between Facebook and your bank. You can—and should—have fun sending and receiving payments on the app. There are emojis, personalized Bitmojis, and thousands of custom animated stickers to play around with.

You can use the app to pay for items at some businesses.

Some businesses accept payments from Venmo. An easy way to pay for items in person is to have a staff member scan your Venmo QR code under the “Show to pay” tool. You can also pay online at millions of retailers using Venmo by looking for a Venmo or Paypal button in your browser or another app. Some popular mobile apps that let you pay via Venmo include Uber, Uber Eats, and Grubhub.

You can tweak your privacy settings for some or all payments.

If you’re feeling squeamish about your spending habits being on display for all the world to see, you can easily change your Venmo privacy settings. Here’s how it works: The “public” setting means that all of your transactions are visible to anyone on the internet. The “friends” setting means that your transactions are visible to your friends and the friends of the sender/recipient for each transaction. The “private” setting is the most locked-down, with transaction details only available to you and the sender/receiver. You can change your privacy settings for all of your transactions (and even past transactions!), or you can change them on a case-by-case basis. You also have the power to block other users.

Now, how to decide which transactions to make public, private, or visible only to friends? That’s really up to you. “As you decide what’s right for you, keep in mind that your friend’s mom or your coworkers may see your Venmo activity in the social feed, and your emojis or an inside joke in the payment note may not always come off as intended,” Mackey says.

You can leave money in your Venmo account or transfer it to another bank account.

If you start to accumulate a sizable balance in your Venmo account, you can leave the money there for future transactions or transfer it to one of your actual bank accounts—it’s really up to you. One thing to keep in mind: Money held in your bank account is secured by the Federal Deposit Insurance Corporation up to $250,000 per person, per account. This means that if your bank goes bust, you won’t lose all of your money (up to a certain point). Venmo, on the other hand, is not backed by the FDIC, which means it’s slightly riskier to keep your money there. Another thing to consider: You won’t earn any interest on your Venmo balance, like you would with a traditional savings or checking account. “It’s a good idea to quickly transfer any sizable balances you accumulate into a high-yield savings account so you can earn interest on your money,” says Kimberly Palmer, NerdWallet’s personal finance expert.

You can also use a Venmo debit or credit card to pay for things.

A lot of us use the Venmo app on our phones, but the company also offers a debit card that you can take shopping in the real world. Venmo also just rolled out a credit card with no annual fee.