How to Save on Everything — 20 Money-Saving Tips to Take the Pressure Off Your Wallet Right Now

Life is expensive. From the price of eggs to airline prices that seem completely unaware they should be begging for forgiveness after the 2022 holiday season, the squeeze on wallets feels stronger than ever.

While there’s no magic bullet to put more money into your checking account (besides, hopefully, getting that well-deserved raise at work), there are budgeting hacks to help take the pressure off every swipe of your credit card. Some are common sense, some are expert level, and some are downright clever, but all will help you get closer to hitting your savings goals this year — even if eggs don’t drop below $4 a dozen.

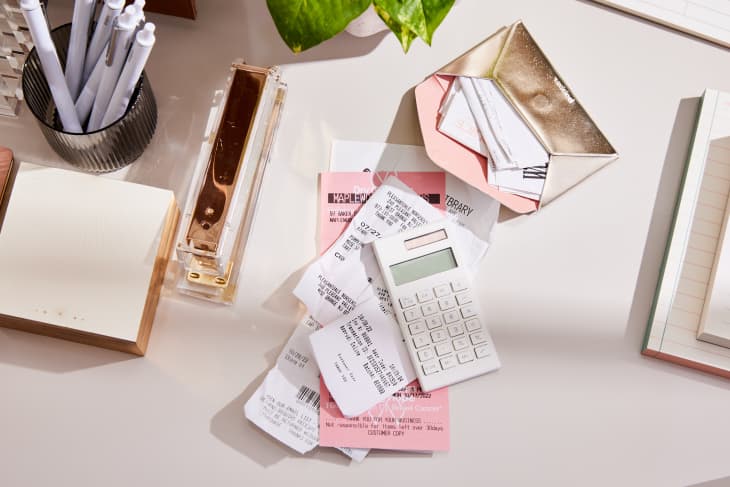

1. Look at Your Numbers

“The best budgeting tip I have is simple, but can be really difficult. You need to look at your numbers,” says Caitlin Earle, owner and CEO of Budget BFF. That includes income, savings, expenses, and credit cards. She explains that you won’t get very far looking for ways to cut expenses and save unless you know the hard numbers. “Once you know your numbers, you can take a good honest look at what is working in your budget and what isn’t — then you can start to make changes,” Earle says.

2. Find a Budgeting App That Works For You

Once you know your numbers, look at how you plan to stay on top of them. For some people, Mint.com is the answer, others prefer You Need a Budget. Maybe you have the ultimate customized Excel sheet.

All of these help you clearly see what’s coming in and out. Jesse Mecham, founder of YNAB, explains, “Sometimes just visualizing where your money is going is eye-opening enough to eliminate hundreds of dollars in expenses.” The key is to find a system that works for you and stick to it.

3. Use Free Curbside Pickup

If every trip to Target ends with an impulse $40 purchase from the latest designer collab or if those new shortbread cookies and lemon alfredo sauce tempt you when you set foot in Trader Joe’s, this tip is for you.

“Take advantage of free curbside grocery pickup services,” says Shonnita Leslie, personal finance expert at Noir in Color. She suggests taking inventory of what you need — and only what you need — and adding those to cart for pickup. “You’ll be less distracted and tempted to buy things you don’t need, you’ll save on gas by avoiding making multiple trips, and having someone else shop for you frees up your time to do other things,” she explains.

4. Buy More Stuff (Yes, Really)

“Bulk buying is one of the most effective, and easy to implement, ways to save some serious cash over time,” says Olle Lind, founder of Buddy. You’ll buy more — and pay more — up front, but the savings are worth it over time, particularly for kitchen and personal items that you use a lot. “Get your calculator out while bulk shopping and work out exactly how to get the most bang for your buck,” says Lind.

5. Try Zero-Based Budgeting

“At the start of each month, give every single dollar you are earning a name,” advises Lind. This is called zero-based budgeting and the goal is to account for every dollar down to zero, including savings, groceries, clothing, entertainment, and more. Every penny gets planned.

“For example, if you earn $2,000 a month, all your spendings and savings would equal $2,000,” says Lind. Anything left over at the end? That’s a welcome surprise for your savings account!

6. Delete Your Food Delivery Apps

Quick — count how many food delivery apps you have on your phone right now. Four? Five? And how often are you tempted to place an order when you’re tired after a long day, even though you know it could mean paying $50 for spaghetti?

“Delete ALL but ONE of your premium delivery services. You can do it!,” says Jacqui Kearns, chief wellbeing officer at Affinity Federal Credit Union. She adds that, according to Statista.com, delivery fees, service fees, and tips make up roughly 36 percent of food delivery costs now. That’s money most people would rather not spend.

7. Evaluate Your Premium Delivery Memberships

Similarly, Kearns advises taking a look at your premium delivery memberships. “Do you really need more than one ‘premium’ delivery membership?,” asks Kearns. If you have Amazon, Target, CVS, Walgreens, and others, you may be able to cut one or more. Yes, Amazon Prime is great, but, at its current annual cost, are you actually getting enough out of it?

8. Remember to Cancel Free Trials

Free trials are tempting. You add in your credit card number, swearing you’ll remember to cancel — until you get charged for that monthly coffee subscription 31 days later. Don’t let it happen again. Put a reminder in your calendar to cancel once the free trial is up and you’ll save yourself money and the time spent emailing customer service.

9. Look to Free First

Need a new crockpot? Want a new dress for that wedding at the beach this summer? Searching for a new mirror? Before you click ‘add to cart,’ look at your local Buy Nothing group. There are seemingly endless items being given away for free, saving you some substantial cash and proving one person’s trash is another’s treasure.

10. Take Steps to Lower Your Bills

Your electricity bill got you down? Consider all possible options to lower your monthly costs, including changing out furnace filters, using ceiling fans, and programming your furnace.

11. Schedule Your Luxuries

Sabino Vargas, certified financial planner at Vanguard Personal Advisor Services, doesn’t believe you should give up all indulgences when you’re trying to spend more intentionally. “If you find you’re mindlessly spending on discretionary items and activities — going out to eat, ride sharing vs. public transportation, online shopping — it may be helpful to set not only a monthly budget of how much you can spend, but when you can spend money on these items,” explains Vargas. It gives you something to look forward to and can make these splurges feel even more special.

12. Book Cheaper Travel

Travel isn’t getting any cheaper, but you can still leverage all the tricks to get a deal on your next flight. Sign up for cheap flight newsletters, set price alerts, learn to use credit card points, and be flexible with your times (though don’t fly in early if the additional cost to stay will negate the savings!).

13. Plan Your Meals Ahead of Time

Accredited financial counselor Jasmine Johnson speaks to everyone when she says, “Every time I leave the house, money begins leaking from my wallet. The car needs gas, my daughter’s school needs a donation, and dinner time is just around the corner.” And since food is one of the expenses that has significantly increased, that’s where she focuses her top budgeting tip.

She plans out meals and restaurants she enjoys in advance, and works those into a weekly menu. “Make your list of restaurants you like, then make a list of meals you thoroughly enjoy eating at home. Planning out the meals you will have in advance each week, but also learn the art of adjusting and controlling only what we can control,” she says. It’s a plan with built-in flexibility, so you can actually follow it.

14. Try the Envelope Method

“Use the popular envelope method where you predetermine how much you will spend in each category,” says Darius Smith of Wealth is My Worth. But he advises bringing it into the 21st century by setting up automated direct deposits into multiple checking accounts rather than using checks and envelopes.

Smith adds, “There is some upfront work, but you will never overspend, never forget to pay down debt, and never forget to invest.”

15. Clip Coupons

Natalie Warb, finance expert at CouponBirds, is a big believer in coupons to help lessen the sting of current prices. She looks to both online and in-store coupons to help save. Don’t worry if you’re not sure where to start — here’s a list of digital coupon plug-ins.

16. Shop Strategically — By Looking at the Calendar

From buying winter coats in February to stocking up on swimsuits in September, shopping off-season can mean super savings. Stack those discounted prices with sales — think Presidents Day, Labor Day, Cyber Monday — and you can get items for a fraction of their original price.

17. Weigh Dining Out vs. Grocery Shopping

This one may be controversial, but Kim Hunter Borst of KHB Financial challenges the idea that groceries are always the most cost-effective option for all people, particularly those who are only feeding themselves and don’t prefer to cook. “When I have clients that do not cook, most of the groceries purchased are thrown out week over week,” explains Borst. “So instead, we set a budget to cover their eating out and ordering-in costs. Counterintuitive, I know, but by eliminating the grocery waste, they actually save.”

18. Create a Capsule Grocery List

Now, if groceries are the more cost effective option for you, here’s a way to save anymore. If you always have the staples on hand, you’re less likely to resort to ordering in last-minute or making a before-dinner run to the grocery store for chicken. Create a “The best budgeting hack to help you save on all facets of your life is putting money aside for the things that truly matter to you first,” says Stu Evans, a CFP at Facet and director of financial planning. That could be retirement, a new home, or an emergency fund, but he explains that by allocating money immediately to the things that matter to you, you’re building the life you want rather than only spending on the short term. If you read the previous tip and thought, “That sounds great, but how am I supposed to ever save for a house?” The numbers may sound intimidating (and they are!), but break it into bite-sized chunks. Set realistic goals every month and don’t get discouraged if it grows slower than you hoped. Slow and steady adds up. March is Smart Spending Month on Apartment Therapy! We’re here to help you put your hard-earned dollars and cents to use — the right way. Head over here to learn how to do no-spend challenges, buy a home for below its listing price, and so much more.

19. Prioritize Your Spending

20. Save in Small Chunks